Project details

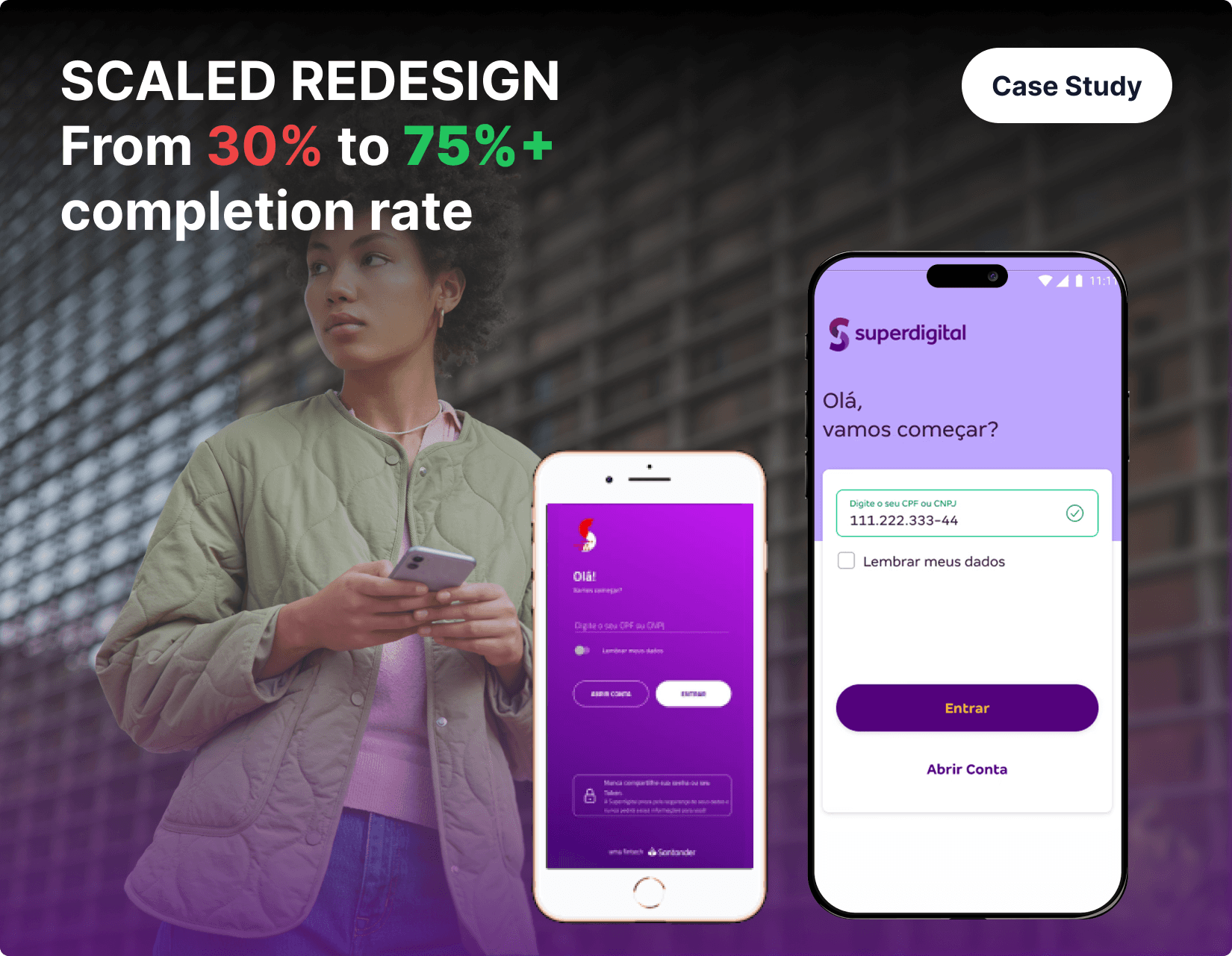

Fintech Onboarding Redesign: Transforming Conversion Through User-Centered Design

Context & Problem Definition

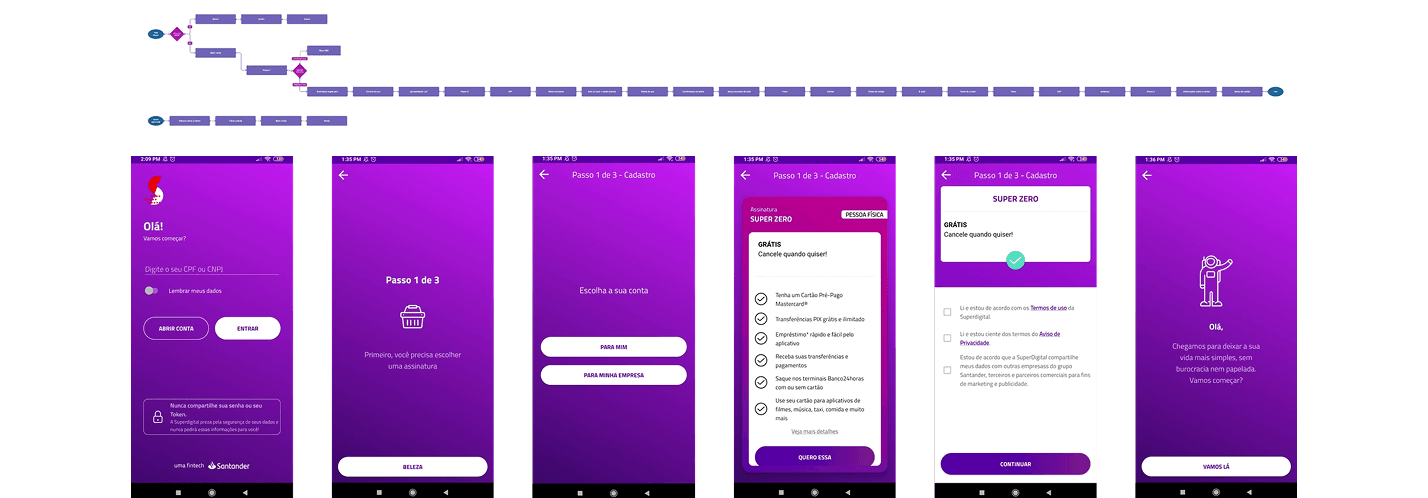

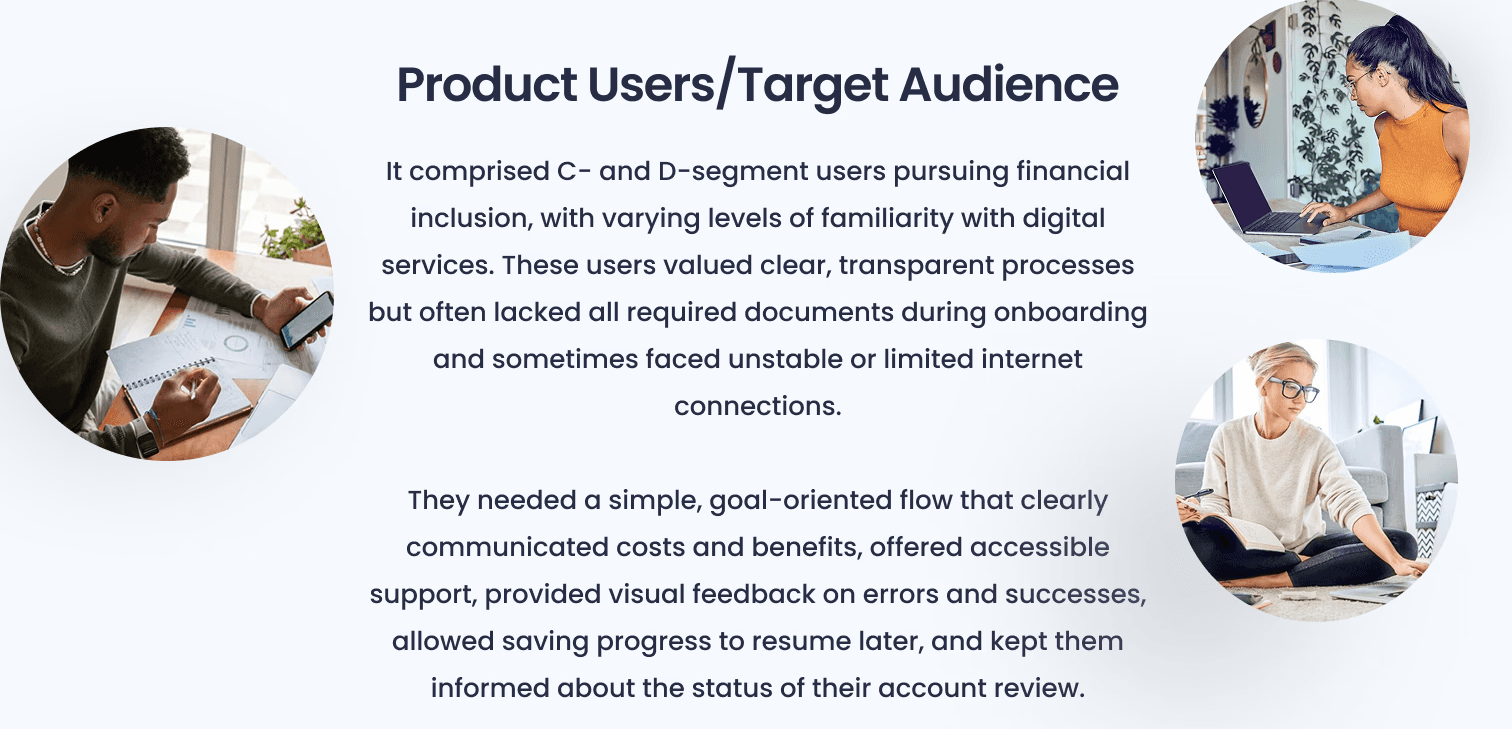

A Brazilian fintech serving classes C and D faced critical conversion challenges with their account opening process. The existing 15-screen onboarding journey achieved only 30% completion rate, creating substantial business inefficiencies and user frustration.

Core Problems Identified:

Complex multi-screen process with excessive friction points

86% of automatically issued cards remained unused, generating massive operational waste

High volume of onboarding-related support tickets indicating user confusion

Outdated UI inconsistent with new brand identity and design system

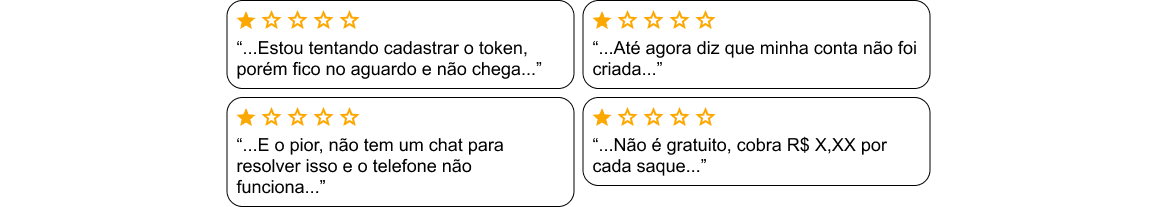

Poor app store ratings reflecting user dissatisfaction with registration experience

Strategic Problem Definition

Priority Issues for Resolution:

Request authentication token only once per session

Implement comprehensive inline error handling

Surface critical information more accessibly

Provide persistent help button functionality

Deliver continuous feedback on account-review status

Group related inputs into logical single screens

Remove unnecessary data collection fields

Improve overall customer communication clarity

Critical Business Insight: Research revealed only 14% of users ever used their issued cards for transactions, while 76% never used cards even once, highlighting massive operational inefficiency opportunity.

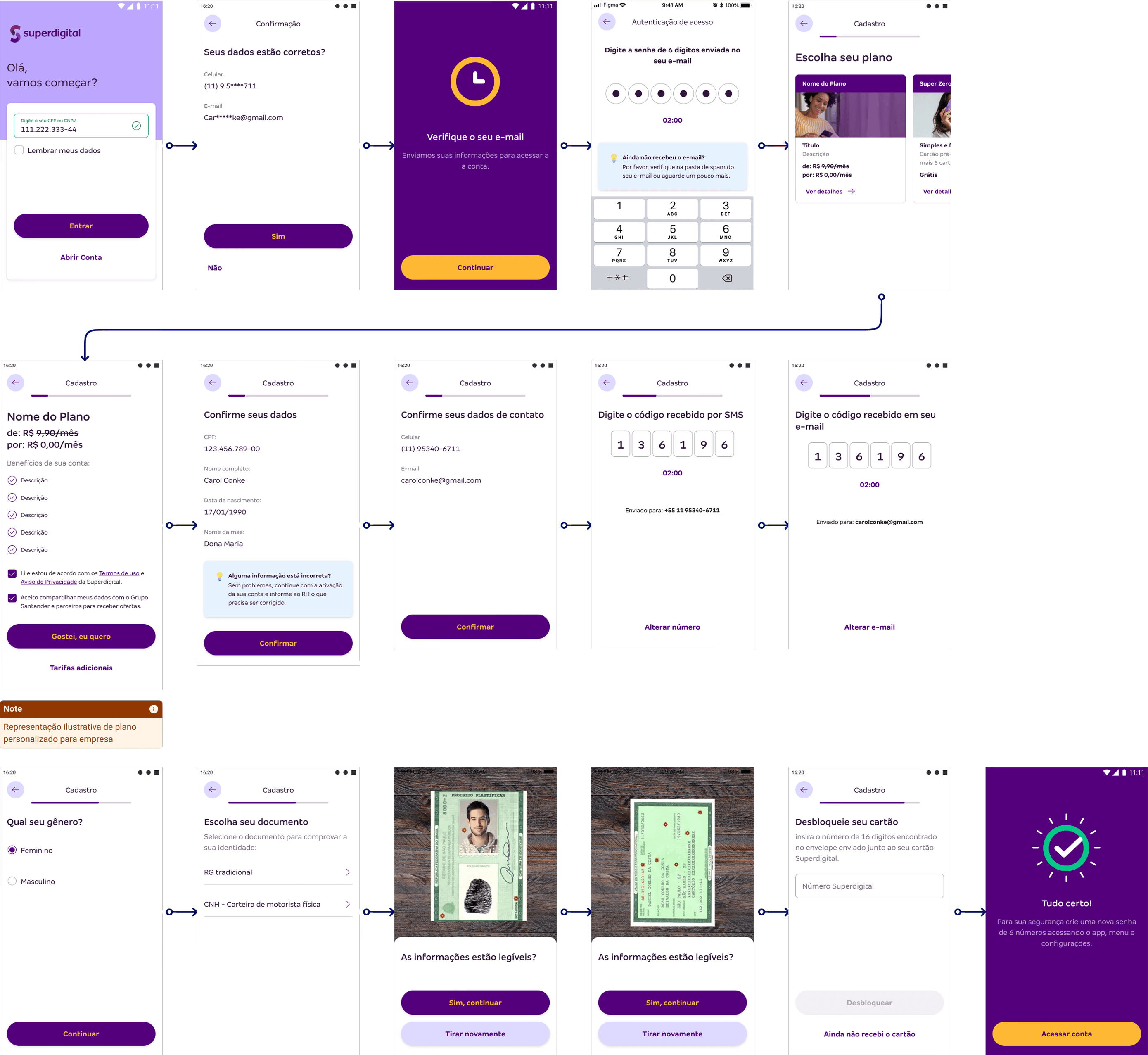

Design Solution & Implementation

Impact-Effort Matrix Analysis: Systematic evaluation of proposed improvements using impact-versus-effort matrix guided prioritization and shaped implementation roadmap.

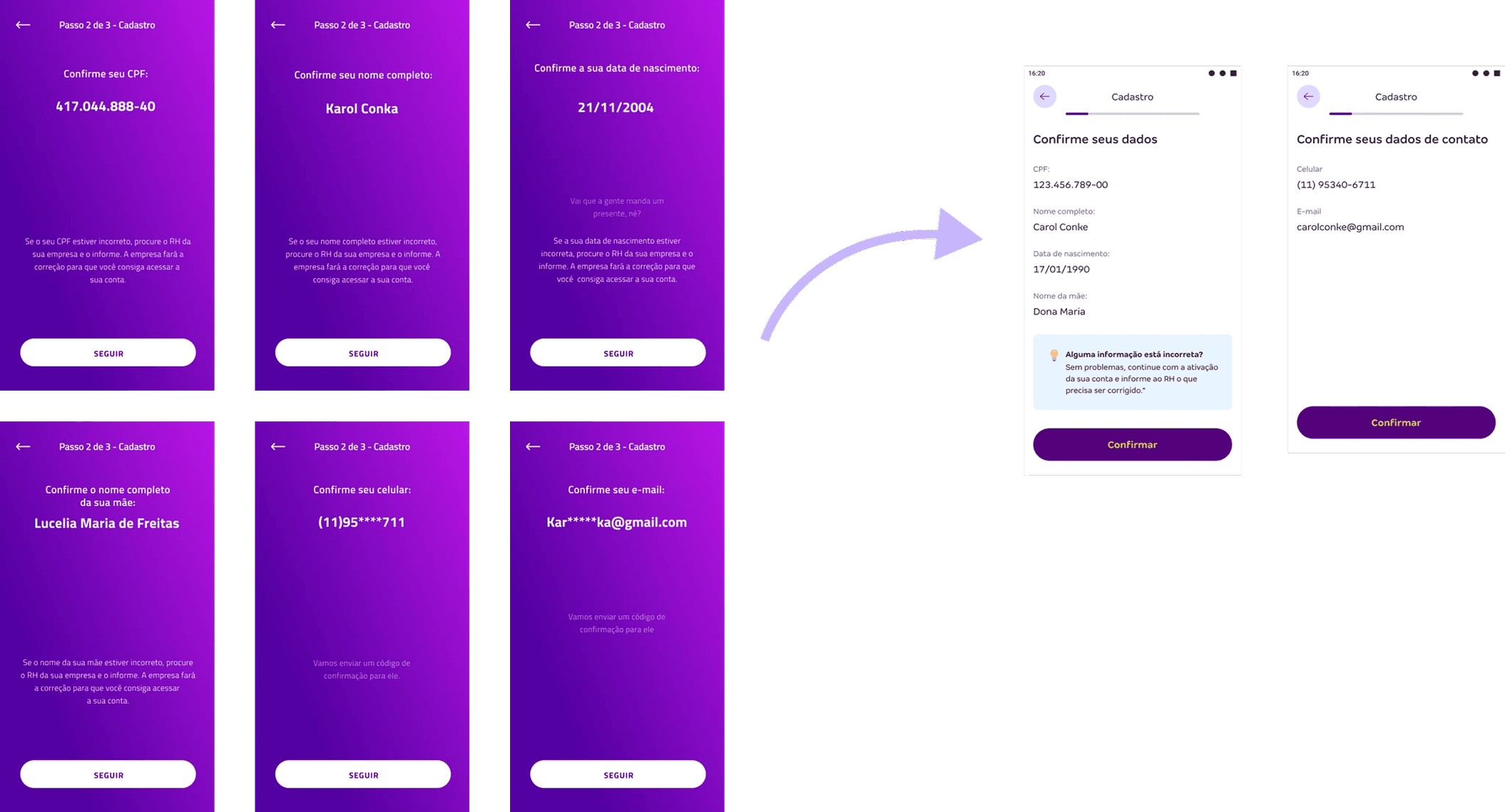

Design System & Rebranding Integration: Applied updated design system across entire onboarding flow, aligning colors, typography, and components with new branding standards. Personal-information checks consolidated into two screens, reducing average clicks from 10 to 4.

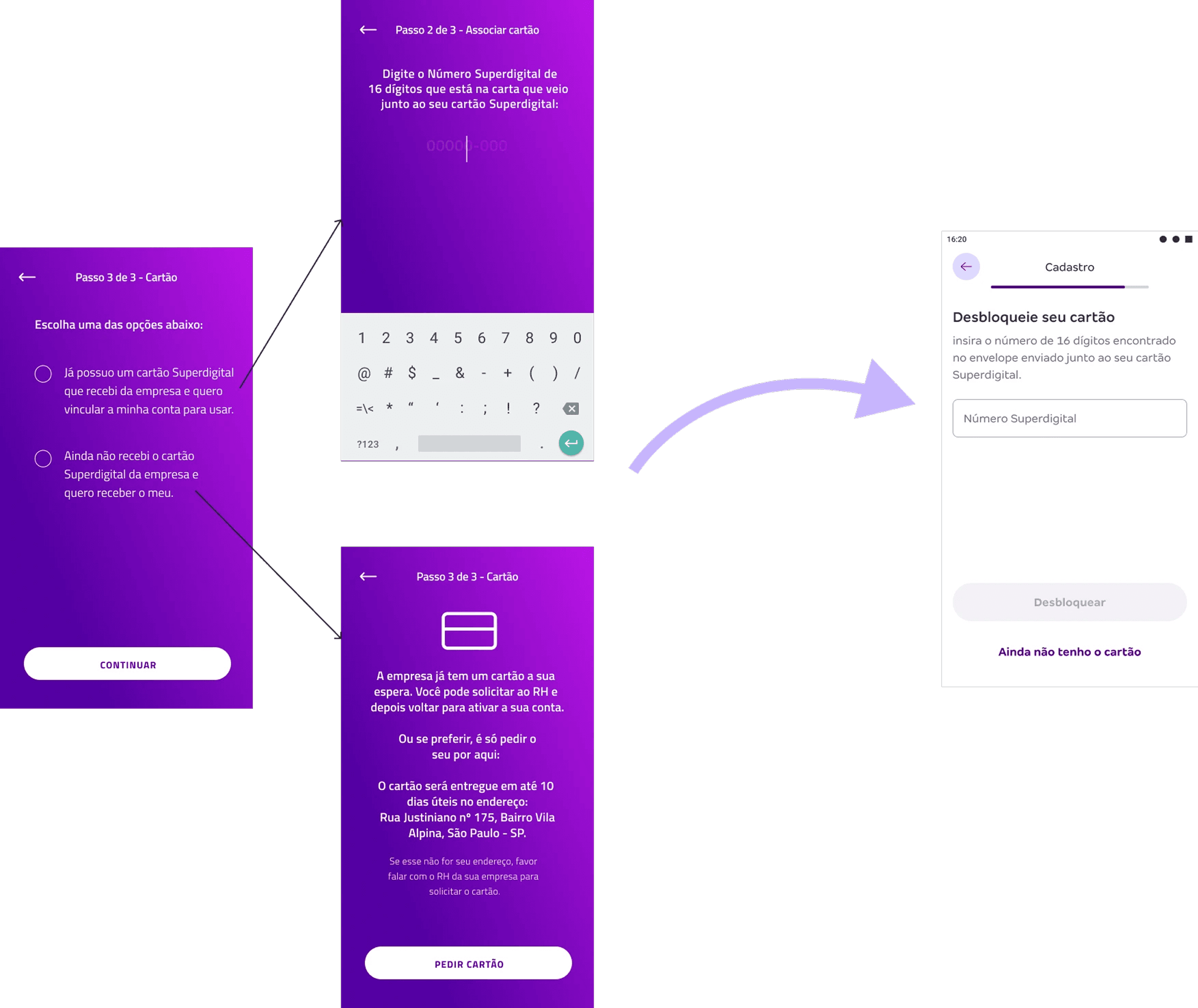

Card Issuance Optimization: Simplified card-association step replacing multi-option chooser with single information-request screen featuring clear "Request Card" option only for users who haven't previously requested, eliminating unnecessary issuance costs.

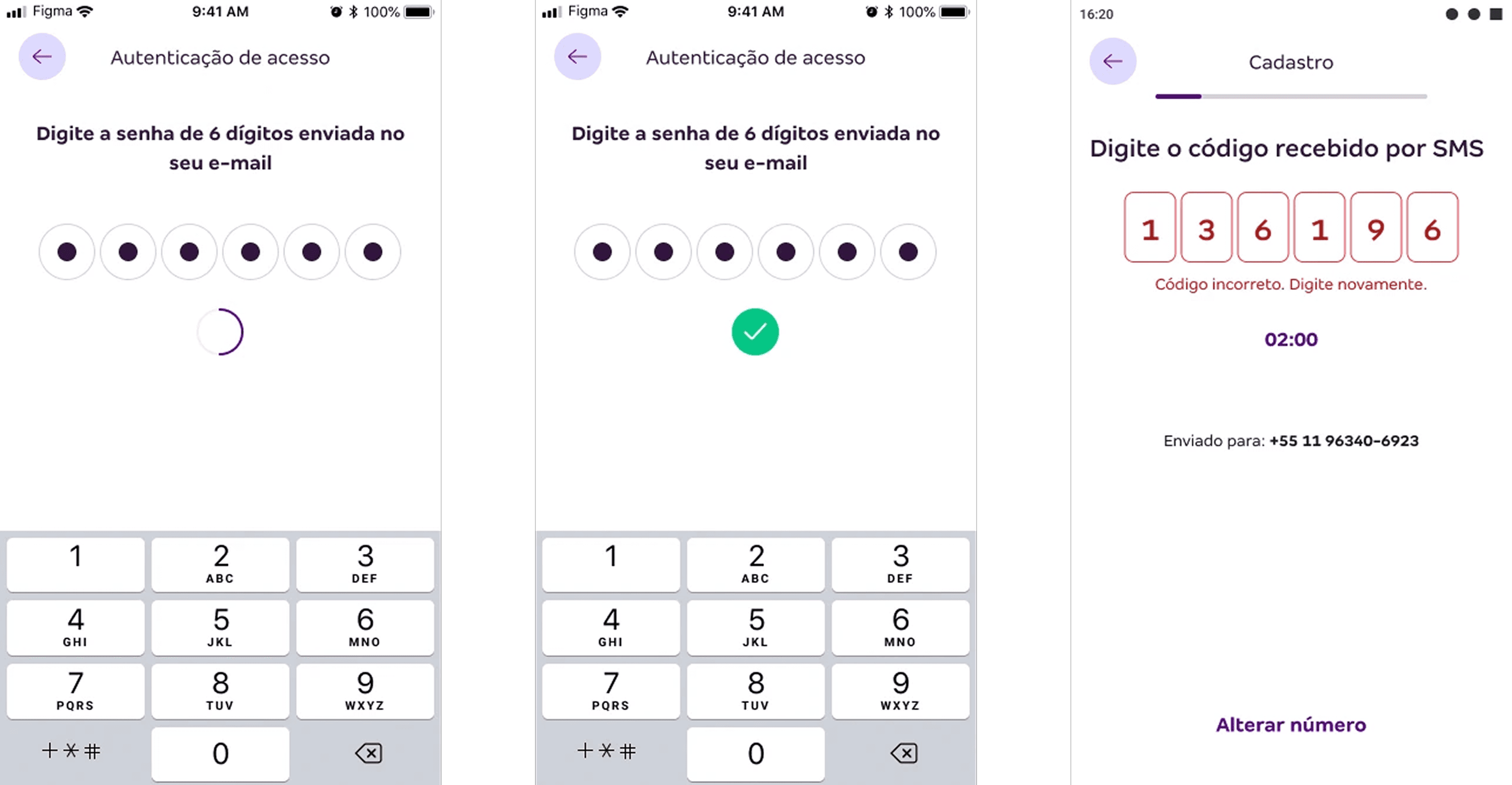

Micro-Interaction Feedback System: Implemented three-tier feedback mechanism guiding users through each step:

Loading States: Every input interaction displays brief loading animation signaling progress

Positive Feedback: Successful inputs transform loading animation into green checkmark

Negative Feedback: Contextual helper text appears on errors, explaining issues and correction methods

Enhanced User Experience Features:

Token requested only once per session with resolved delivery instabilities

Help and contact options added for ongoing support

Streamlined flow optimized for speed, agility, and user-friendliness

Specific Design Solutions

Account Selection Redesign: Redesigned account selection screen clearly differentiating each account type using visuals, descriptions, and larger tap areas, making selection process more intuitive and visually appealing.

Progress Visualization: Removed screens indicating next steps, replaced with progress bar allowing users to track journey more efficiently.

Plan Selection Enhancement: Redesigned plan selection using carousel format displaying all available options. Each plan includes clear details on benefits, pricing, and additional fees, promoting transparency and informed decision-making.

Resume Functionality: Implemented save-and-resume capability allowing users to continue from interruption point or restart completely through simplified, straightforward design.

Behavioral Analysis

App store reviews and support tickets exposed three critical failure patterns:

- Token delivery failures creating authentication loops

- Unclear fee structure generating trust issues

- Absent feedback mechanisms causing abandonment anxiety

Market Context

Benchmarking C/D-focused fintechs revealed standard patterns this product was missing: progress indicators, contextual help, and save-and-resume functionality and essential for users with intermittent connectivity and shared devices.

Critical Discovery

Only 14% of issued cards were ever used, while 86% remained dormant, indicating fundamental misalignment between onboarding promises and actual user needs. This insight shifted focus from card activation to genuine product engagement.

Solution Design

System Integration & Flow Optimization

Applied the updated design system while restructuring the information architecture. Consolidated personal-information confirmations from multiple screens into two focused inputs, reducing core interaction from 10 to 4 clicks. Replaced standalone "next step" screens with a persistent progress bar, giving users continuous journey visibility—essential for the C/D demographic managing unfamiliar financial processes.

Card Issuance Transformation

Eliminated automatic card generation that created 86% waste. Redesigned the selection interface from complex multi-option chooser to single information screen with contextual "Request Card" option—only visible for users who haven't previously requested. This strategic shift cut annual card costs by 89% while preserving user agency.

Feedback Architecture

Implemented comprehensive micro-interaction system addressing user review complaints about "no feedback":

- Loading states for every input with brief animations signaling system response

- Positive confirmations morphing loading into green checkmarks for successful inputs

- Contextual error handling with helper text explaining issues and correction methods

This feedback loop substantially enhanced user confidence and directly contributed to completion rate improvements.

Enhanced User Journey

- Single-session authentication: Token requested once per session, eliminating the repetitive loops causing early abandonment

- Save & Resume functionality: Critical for users with connectivity constraints or shared devices

- Transparent plan selection: Carousel format with comprehensive benefit details, clear pricing, and fee breakdowns, directly addressing trust issues identified in user research

Account Selection Redesign

Enhanced visual differentiation between account types using improved descriptions and larger tap areas, making selection more intuitive for users less familiar with financial product categories.

Implementation Constraints

Timeline and technical limitations required strategic compromises: help and contact features were deferred to post-launch phases, and some validation processes remained server-side, creating minor latency issues later optimized.

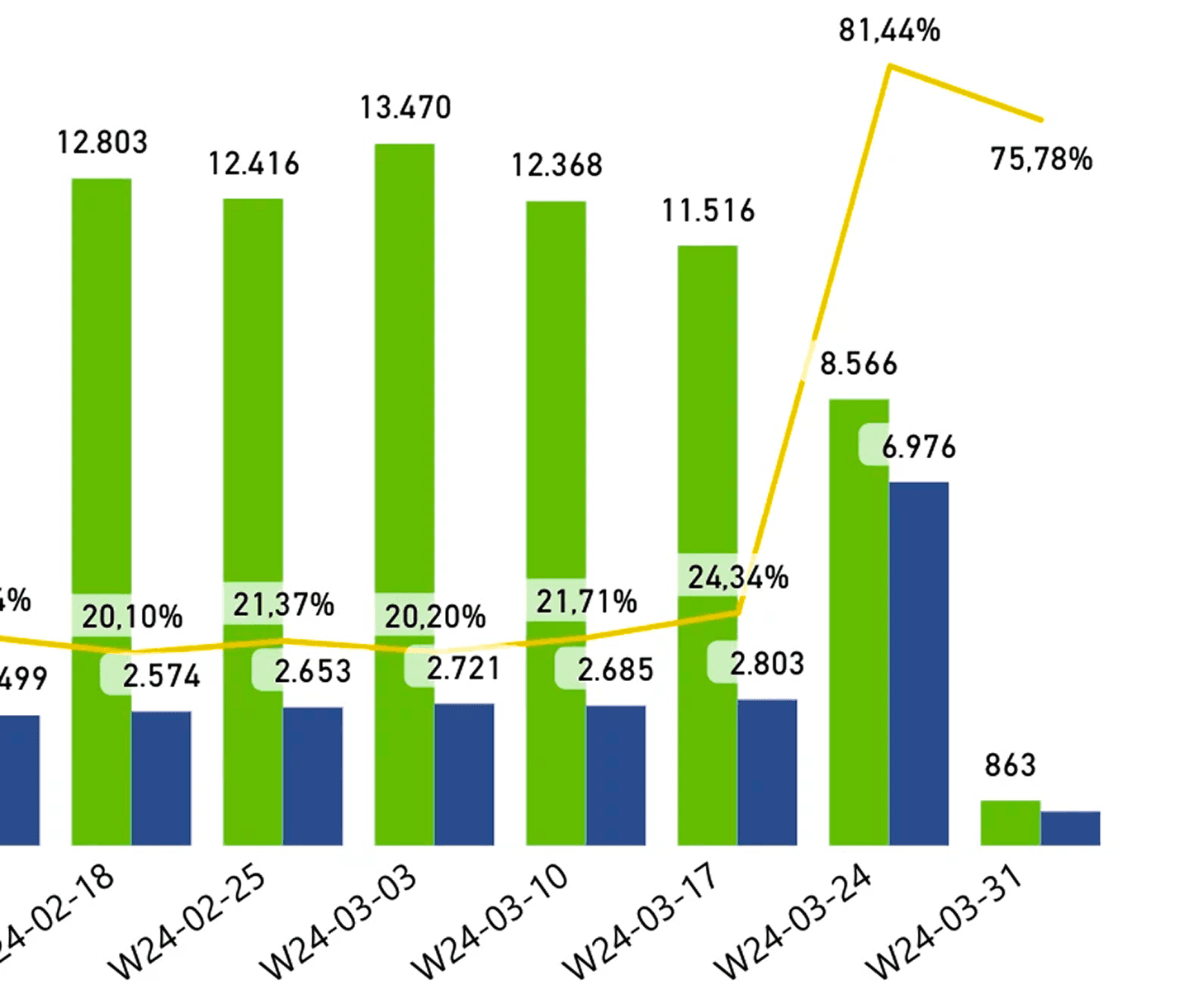

Measured Impact

The strategic redesign delivered measurable business transformation:

- Completion rates: 30% → 75%+

- Plan sales: 4x increase (first month)

- Support tickets: 43% reduction

- Customer conversions: 60%+ growth

- Operational efficiency: 89% card cost reduction

- User satisfaction: Consistent app store rating improvements

These results demonstrate how user-centered design decisions can simultaneously solve customer pain points and business inefficiencies, particularly when solutions are tailored to specific demographic constraints and behaviors.

Role & Contribution

Research Leadership:

Spearheaded competitive analysis and conducted comprehensive user review assessments

Created detailed process maps revealing critical insights about user friction points

Led impact-effort matrix analysis guiding strategic prioritization decisions

Interaction Design Innovation:

Developed comprehensive micro-interaction system designing intuitive feedback with contextual loading states, positive confirmations, and clear error guidance

Created substantial enhancements to user confidence and flow completion through thoughtful interaction patterns

Cross-Functional Integration:

Collaborated with design system team ensuring visual consistency across all touchpoints

Aligned with business stakeholders on strategic objectives despite significant technical and timeline constraints

Coordinated implementation priorities balancing user experience goals with operational efficiency requirements

Results & Business Impact

Conversion Metrics:

Onboarding completion rates increased from below 30% to over 75%

Overall customer conversion grew by 60%

Plan sales quadrupled in the first month post-launch

Operational Efficiency:

Annual card issuance costs reduced by 89% through optimized request process

Onboarding-related support tickets decreased by 43%

App store ratings showed consistent improvement trajectory

User Experience Validation:

Streamlined user journey with consolidated screens and reduced friction

Enhanced feedback systems providing clear guidance throughout process

Improved transparency in plan selection and fee communication

Strategic Impact: The redesign demonstrated how user-centered design principles can simultaneously enhance user experience and drive substantial operational efficiency improvements. By focusing on highest-impact opportunities—consolidating screens, optimizing feedback systems, and eliminating wasteful processes—the solution established foundation for long-term customer satisfaction while delivering immediate conversion improvements.