Project details

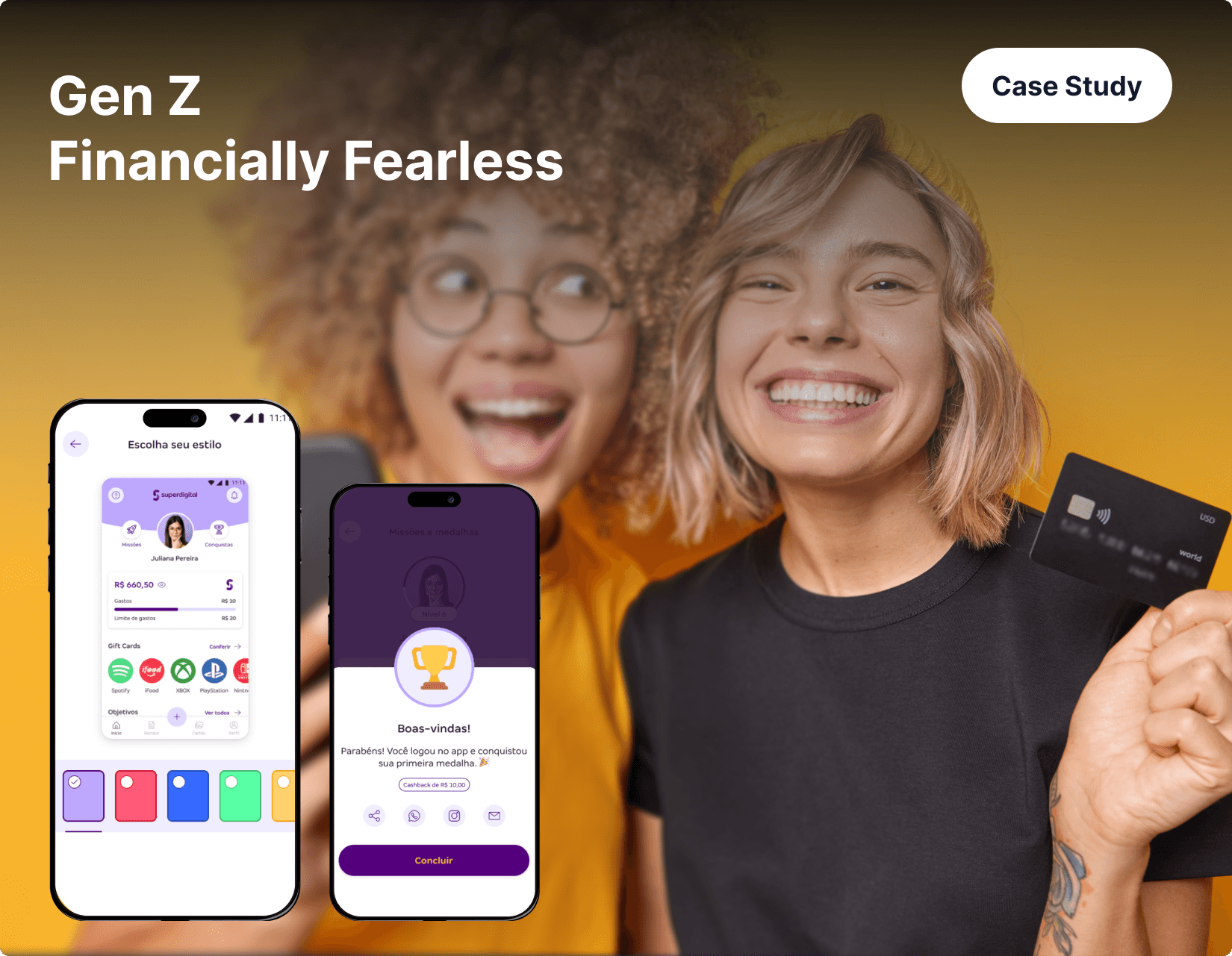

Fintech Gen Z Engagement: Redesigning for Digital Natives

Context & Strategic Opportunity

Fintec Super* experienced 60% growth in registrations and card/app usage throughout 2023, yet identified critical untapped potential in Generation Z engagement (15–21 years). This demographic represents strategic value beyond future customer acquisition—they function as brand perception shapers and loyalty drivers when engaged early in their financial journey.

Core Challenge: Gen Z behavioral patterns—instant gratification-seeking, legacy bank distrust, and demand for personalized value-driven services—conflicted directly with the existing one-size-fits-all app approach. The platform required fundamental rethinking to deliver intuitive, authentic, and culturally resonant financial experiences.

Strategic Objectives

Primary Goals:

Overhaul core UX focusing on onboarding, payment flows, and visual design to captivate Gen Z through culturally resonant features

Achieve 35% increase in Gen Z user acquisition within 6 months post-relaunch via targeted marketing and viral campaigns

Drive 40% weekly engagement increase (transactions, savings goals, feature interactions) establishing the app as primary financial hub

Secondary Goals:

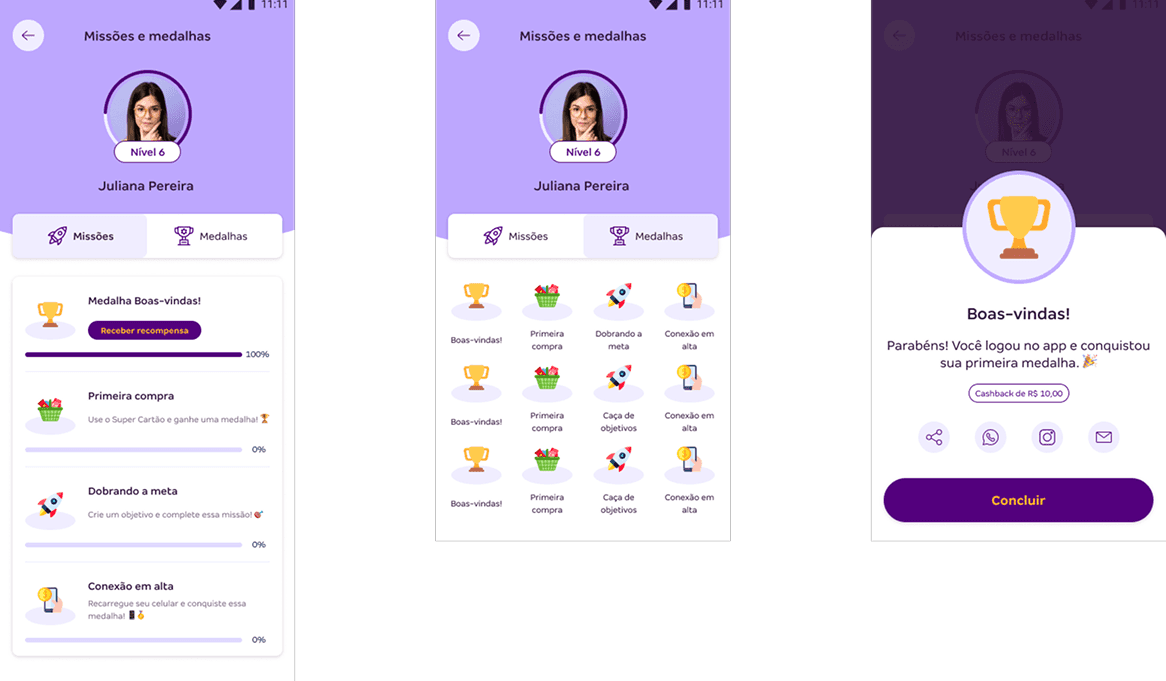

Embed gamified financial education tools (savings challenges, budgeting quests) driving measurable behavioral improvements

Develop optional parent-teen financial tools (allowance tracking, supervised accounts) for 15–17 age group, balancing autonomy with oversight

Position platform as Gen Z's preferred fintech through authentic brand advocacy via social media campaigns and community initiatives

Success Metrics:

App download to completed registration conversion rate improvement

Weekly active user engagement frequency

Average session duration optimization

Gamified mission completion targeting 10 monthly completions per active user

Business Challenges Analysis

Strategic Constraints:

Adapting existing visual identity while creating youth appeal without compromising brand consistency

Balancing simplicity for financial novices with robustness for emerging user needs

Competing against digital-native fintechs offering modern interfaces and gamified features

Operational Complexities:

Implementing gamification encouraging financially responsible behaviors rather than pure engagement

Developing parental supervision systems preserving user autonomy perception

Ensuring regulatory compliance for minor account regulations

Technical Requirements:

Integrating mission/rewards systems into existing core banking infrastructure

Maintaining app performance despite interactive and gamified element additions

Ensuring enhanced security/privacy for digitally vulnerable demographic

Research Methodology

Discovery Phase:

12 in-depth interviews with 15–21 year-olds mapping financial habits, aspirations, and frustrations

8 guardian conversations identifying concerns and expectations

Structured competitive analysis of 5 youth-focused competitor apps

Applied color psychology research for target audience visual impact

Co-creation workshop with 6 young participants for feature ideation

Definition & Ideation:

User journey mapping for critical young user moments

Research-based persona creation

Multidisciplinary team feature ideation and prioritization

Low-fidelity prototyping for rapid concept validation

Validation & Implementation:

Interactive prototype usability testing

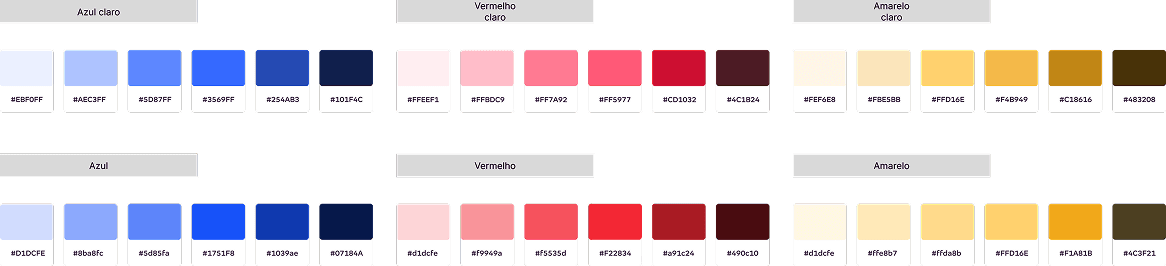

A/B testing for gamification elements and color palette

Beta group iterative implementation with continuous feedback

Target Audience Analysis

Demographic Profile:

Ages 15–21, concentrated focus on 16–18 transitional independence group

Urban and metropolitan area residents

Diverse socioeconomic profile emphasizing classes C and D

Behavioral Characteristics:

Digitally Fluent: Intuitive technology familiarity with seamless interface expectations

Instant Gratification-Seeking: Value rapid responses and immediate rewards

Socially Connected: Peer opinion and social trend influenced

Independence-Driven: Seek decision autonomy, including financial choices

Engagement-Curious: Interested in financial learning through engaging formats

Design Research & Strategy

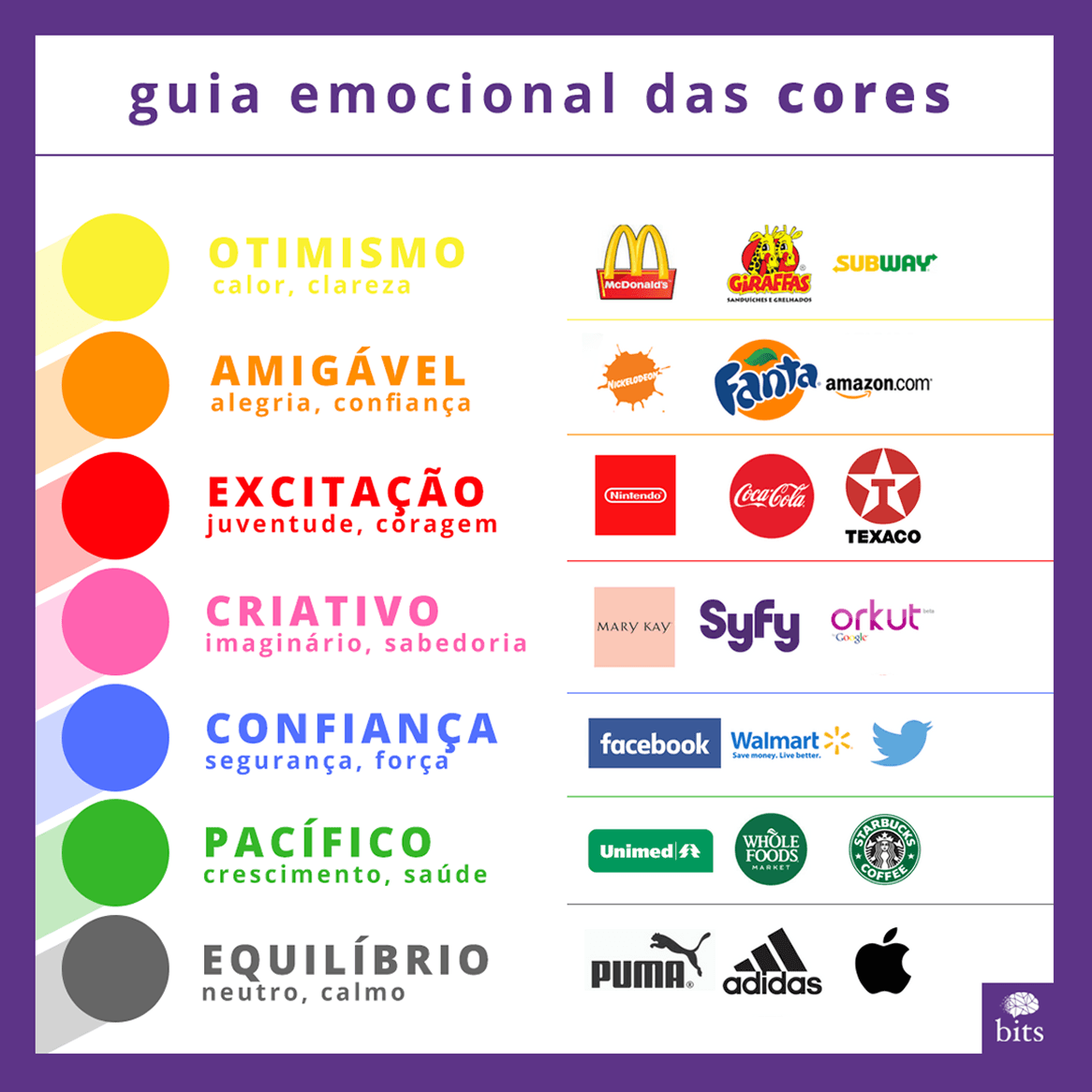

Color Psychology Application: Color psychology research revealed critical insights for financial app engagement, with strategic color selection directly influencing user emotions, conversions, and brand identity formation.

Research Findings:

85% of consumers cite color as primary product selection factor

Blue conveys trust and security (essential for financial apps)

Yellow represents optimism and positivity (appeals to younger audiences)

App interfaces should limit palettes to 4 colors maximum preventing visual clutter

Financial apps require balance between trust signals (blues) and energy indicators (warmer tones)

Color Scheme Strategy: Maintained existing yellow-focused palette leveraging established brand recognition while appealing to youth through optimism and energy associations.

Strategic Color Decisions:

Limited palette prevents visual clutter improving interface usability

Yellow resonates with younger audiences conveying optimism and energy

Existing color scheme maintenance builds on established brand recognition

Color consistency across platforms strengthens overall brand identity

Competitive Analysis & Feature Prioritization

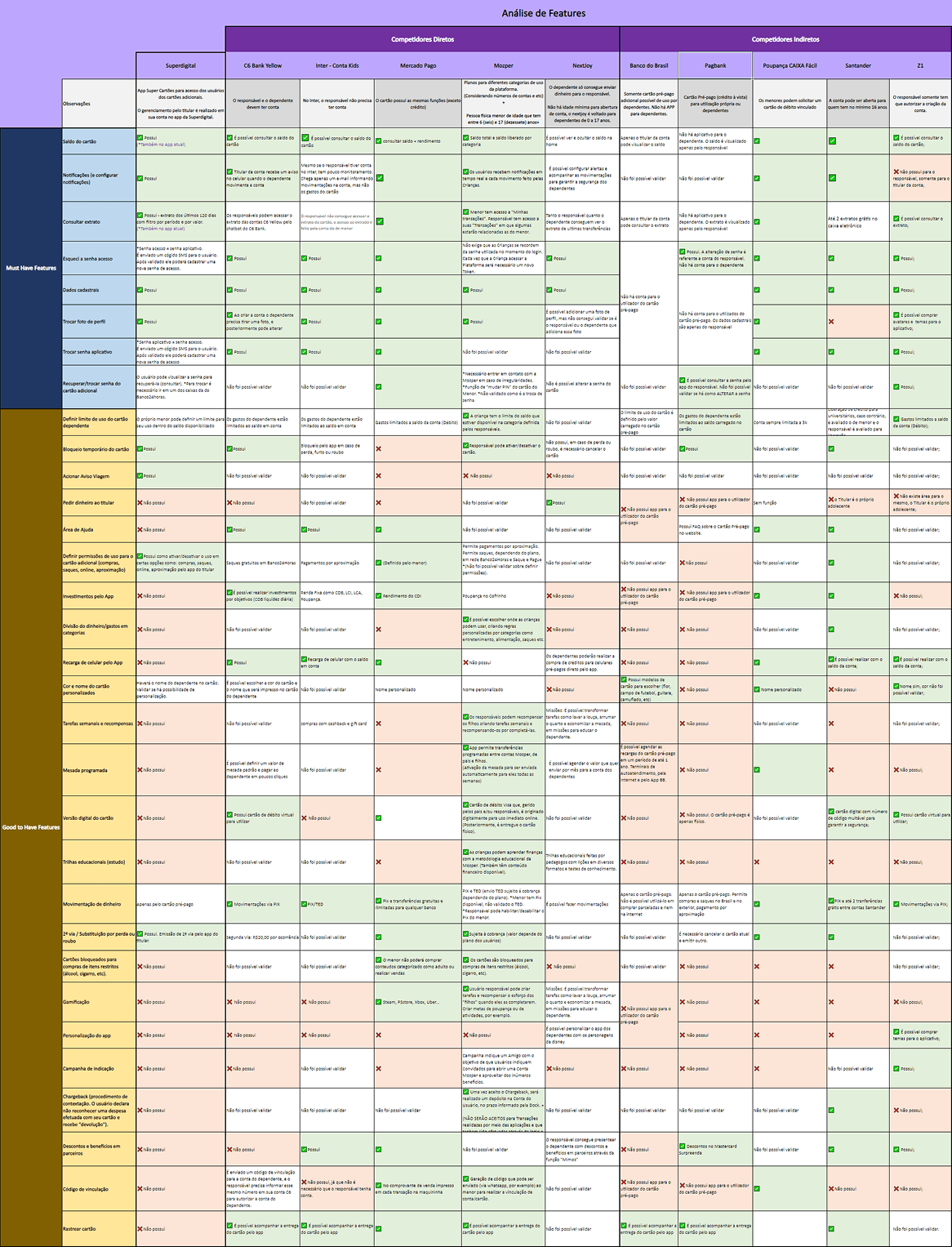

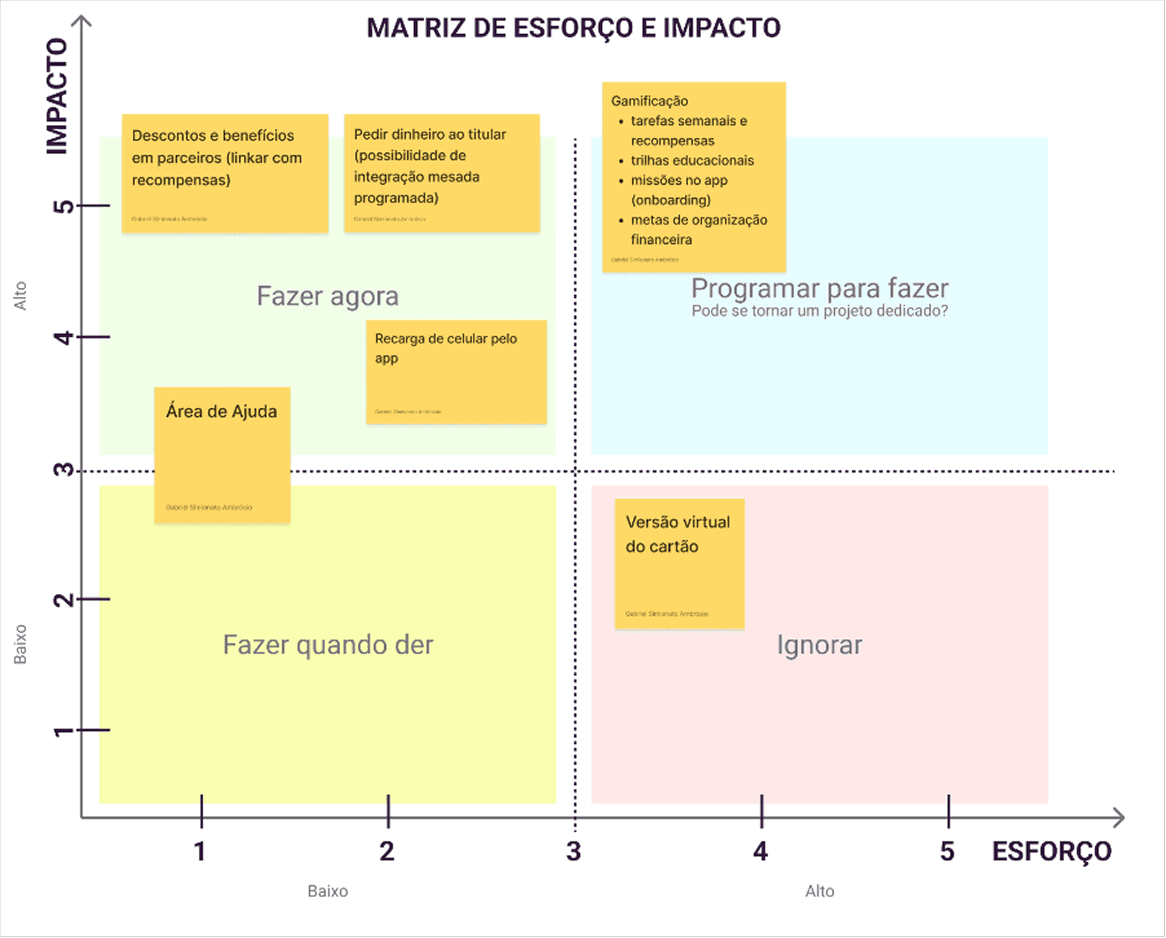

Benchmarking Framework: Comprehensive competitor analysis developed detailed functionality matrix enabling strategic feature selection for maximum value enhancement while maintaining target demographic alignment.

Effort-Impact Matrix: Systematic feature categorization based on implementation complexity versus projected user value, creating visual decision-making tool optimizing resource allocation while ensuring technical feasibility.

Interface Development & Iteration

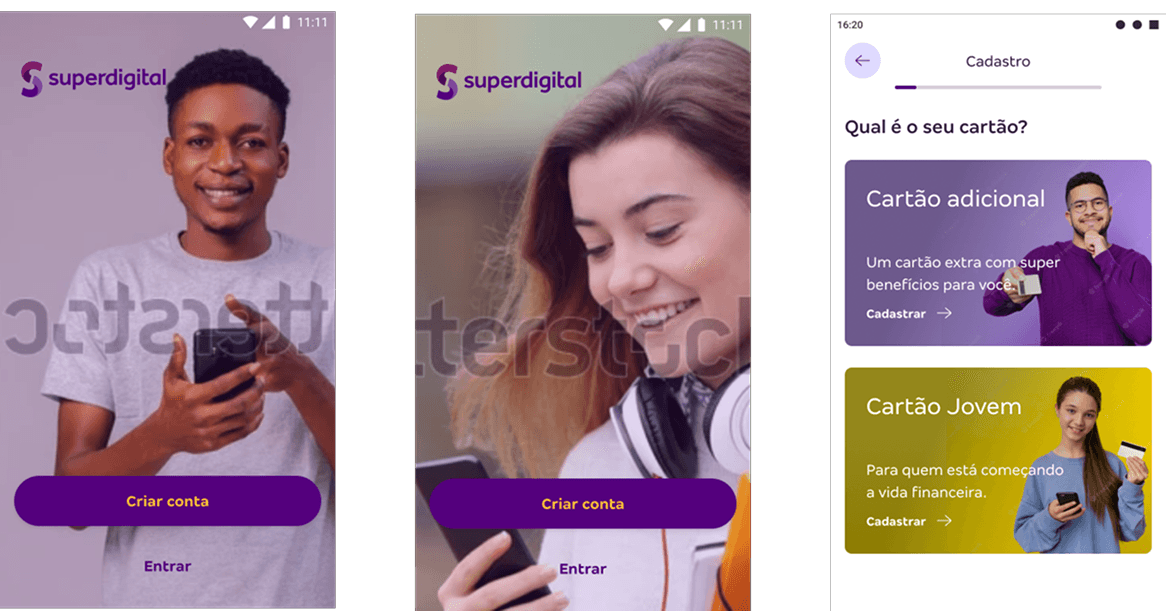

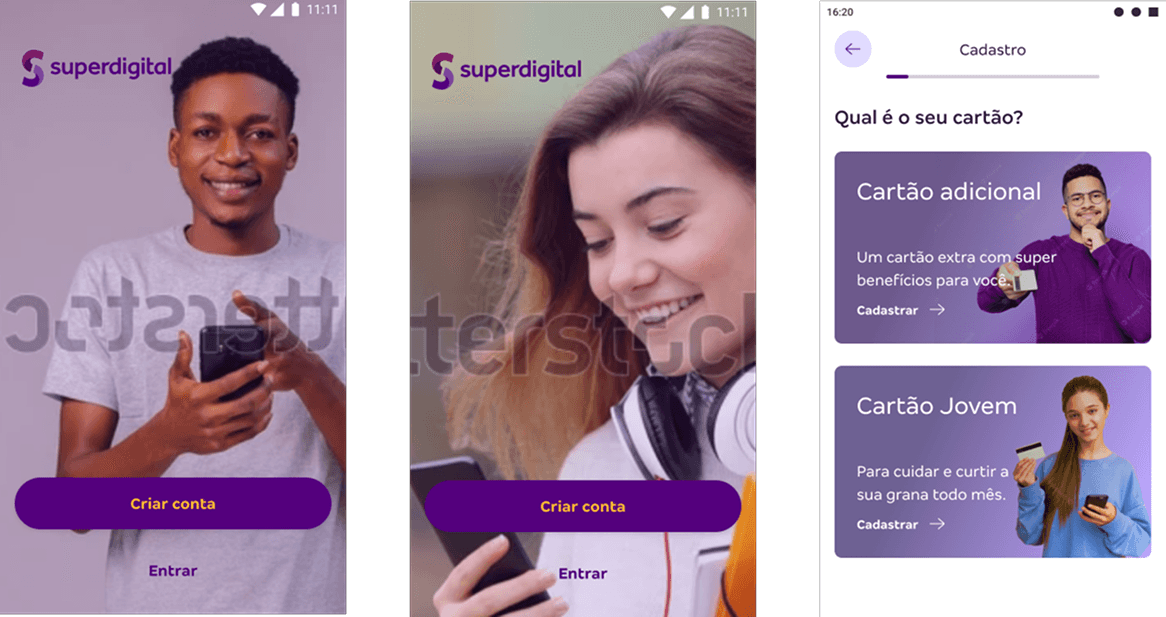

Onboarding Experience: Version 1: Specialized onboarding retaining core functional framework while incorporating visual and interactive elements calibrated for target audience digital expectations and financial literacy levels.

Version 2: Strategic refinements based on high-fidelity prototype evaluation, user feedback, and usability testing to enhance adoption metrics and initial platform engagement.

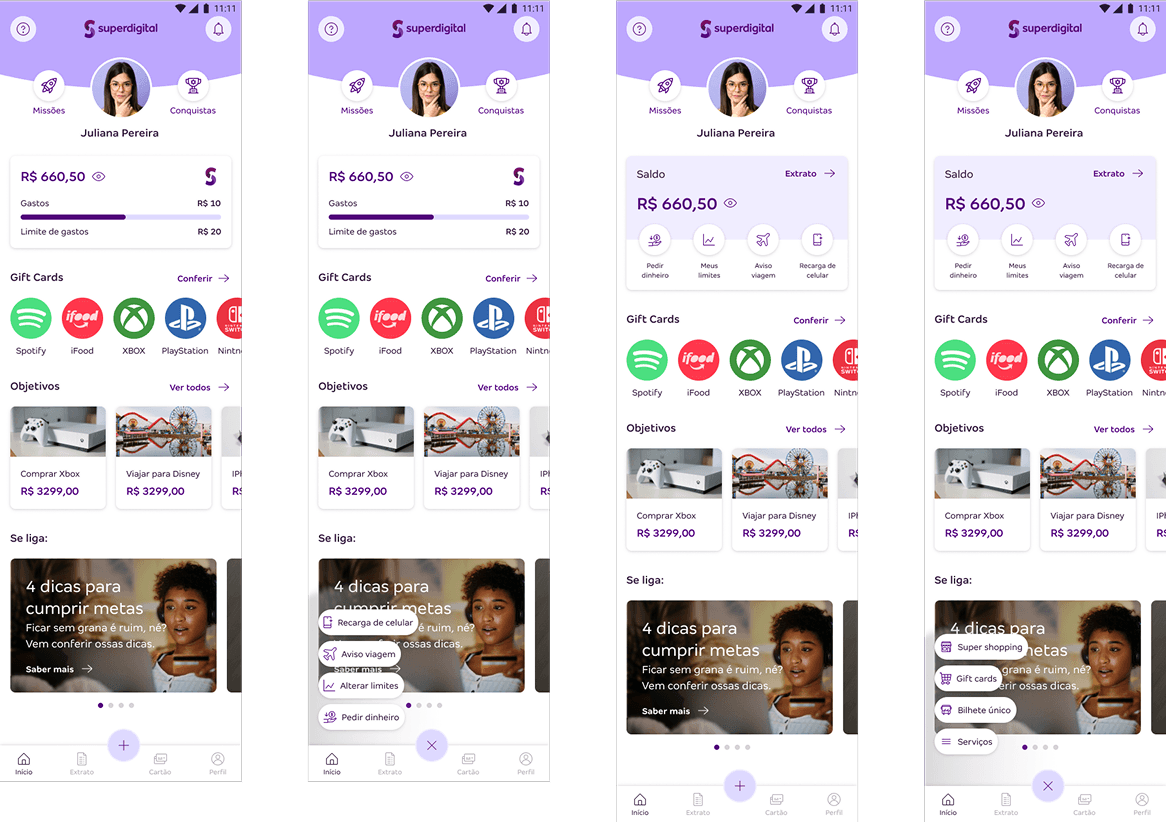

Homepage Design: Version 1: Initial design preserving essential Fintec Super* ecosystem functionality while introducing age-appropriate UI modifications, content presentation strategies, and navigational structures optimized for users beginning financial journey.

Version 2: Iterative high-fidelity development incorporating user interaction insights to optimize information hierarchy, feature accessibility, and visual communication effectiveness.

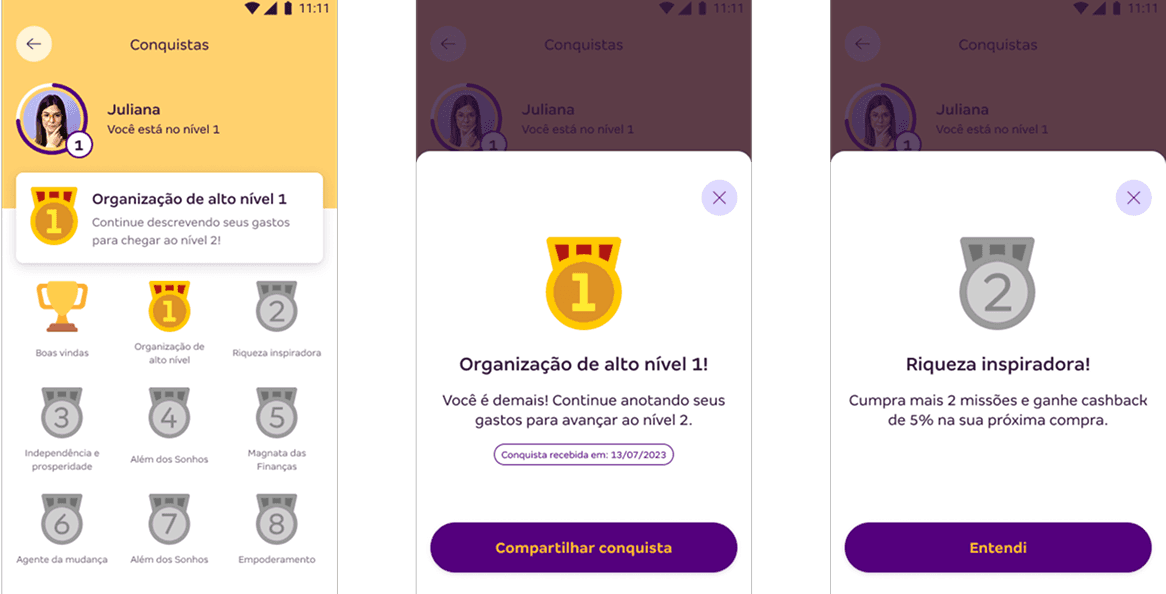

Gamification System: Achievements Version 1: Dedicated achievements interface supporting gamification strategy through engagement mechanisms reinforcing positive financial behaviors via recognition and reward systems targeting developmental motivators.

Achievements Version 2: Comprehensive refinement following initial high-fidelity implementation, enhancing reward mechanisms and progress visualization strengthening behavioral reinforcement and sustained engagement.

Feature Implementation

Profile Management: Interface maintaining functional continuity with Fintec Super* ecosystem while introducing personalization options and presentation formats relevant to younger users' identity expression preferences and privacy considerations.

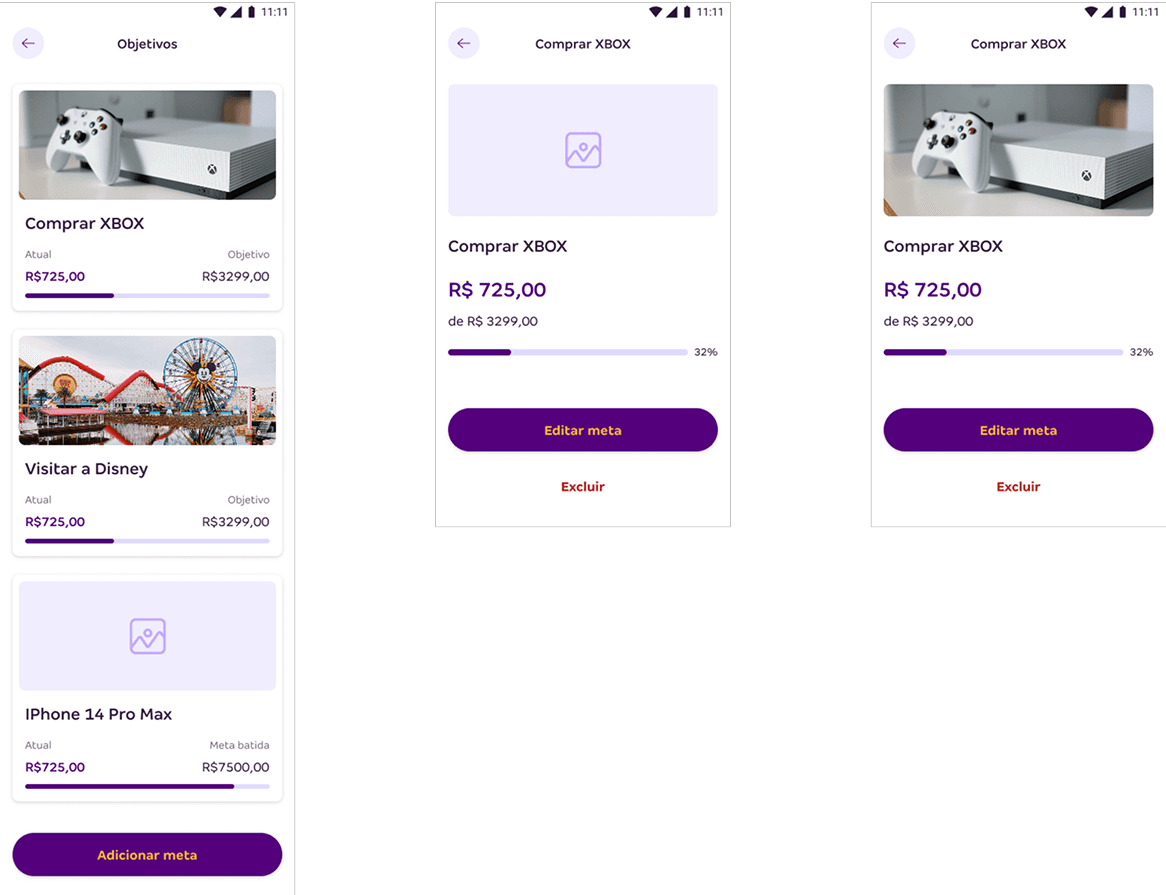

Goals System: Dedicated goals interface providing structured financial objective setting capabilities, completing gamification ecosystem by creating clear achievement pathways connecting aspirational targets with incremental progress recognition.

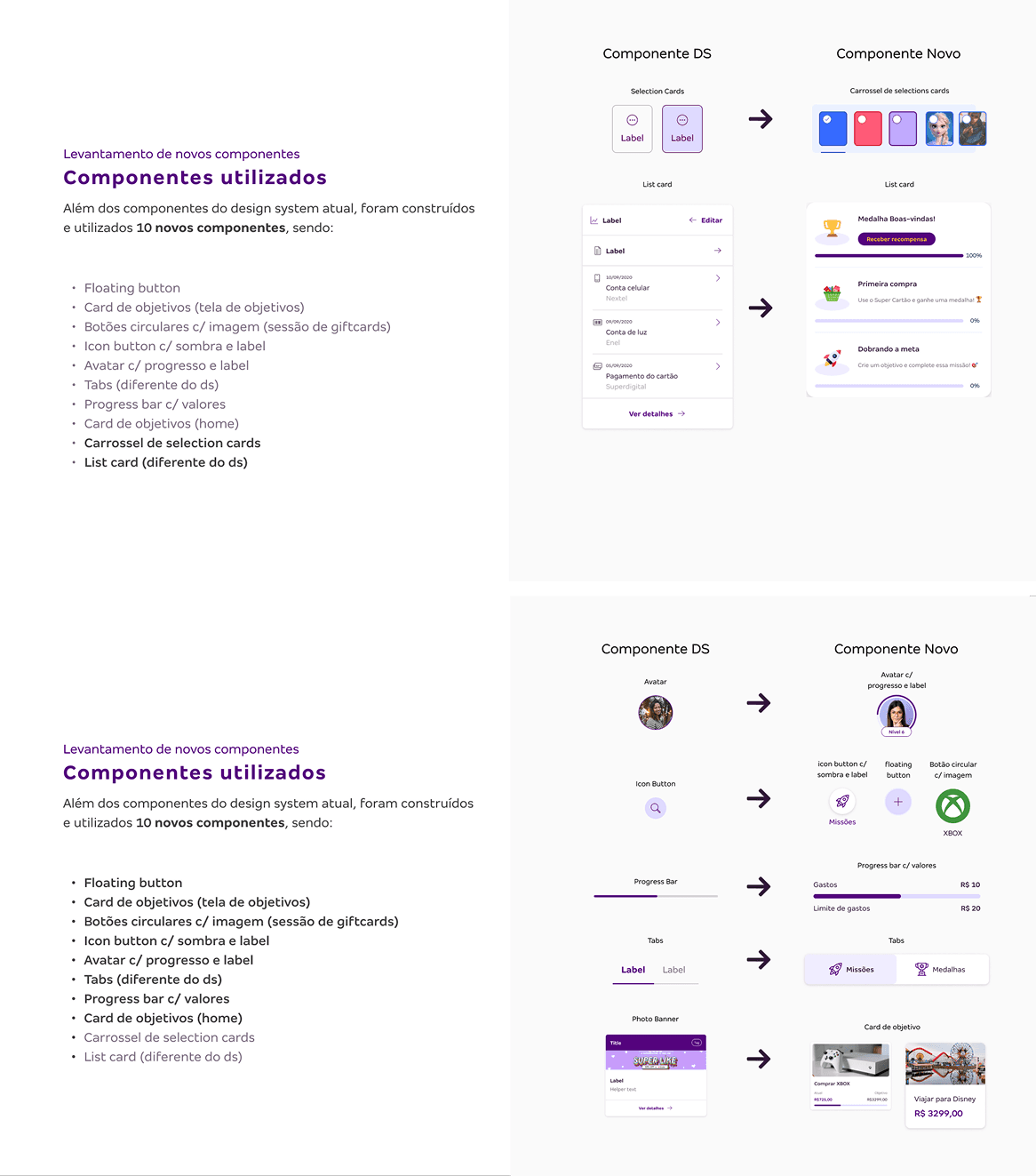

Themes & Personalization: Comprehensive themes section empowering users to personalize interface experience through visual preference selection, enhancing emotional platform connection. Framework designed with extensible architecture accommodating future brand partnership opportunities, creating scalable engagement channel evolving through co-branded visual experiences with lifestyle and entertainment partners resonating with target demographic.

Role & Contribution

As Product Designer leading redesign efforts, contributions encompassed:

End-to-end Research: Spearheaded competitive analysis, conducted comprehensive user review assessments, created process maps revealing critical insights

Cross-functional Integration: Collaborated with design system team ensuring visual consistency while aligning with business stakeholders on strategic objectives despite technical and timeline constraints